Making Informed Choices: Your Guide to Medicare Open Enrollment

Making Informed Choices: Your Guide to Medicare Open Enrollment

The arrival of fall brings not just changing leaves, but also a crucial period for Medicare beneficiaries: Open Enrollment. Open Enrollment is not only for those considering changes; it's an annual opportunity to review your current coverage and ensure it still aligns with your evolving needs. This annual opportunity, typically running from October 15th to December 7th, allows you to evaluate and potentially change your health and prescription drug coverage plans for the following year.

Why is Open Enrollment Important?

Open Enrollment is a crucial period for Medicare beneficiaries to review and potentially adjust their health and drug coverage plans. It typically runs from October 15th to December 7th each year. During this time, individuals can switch between Traditional Medicare and Medicare Advantage plans, as well as modify their Medicare Part D prescription drug coverage.

This annual opportunity allows beneficiaries to adapt their coverage to their changing needs, explore new plan options, potentially save on costs, and address any gaps in their current coverage. By taking advantage of Open Enrollment, individuals can ensure they have the right Medicare plan to meet their healthcare needs throughout the year.

- Adapting to Evolving Needs: As we age, our healthcare needs may change. Open Enrollment lets you adjust your coverage to better suit your current and anticipated medical requirements.

- Exploring New Options: Medicare plans are constantly evolving. Open Enrollment allows you to explore new options that might offer better benefits or cost savings.

- Maximizing Savings: Comparing plans can help you find options that offer better coverage at lower premiums. Your medical needs and potential healthcare expenses should guide your decision, not long-term projections.

- Closing Coverage Gaps: Open Enrollment gives you the chance to address any gaps in your current coverage, filling needs like prescription drug support, dental, or vision care.

Understanding Medicare Coverage Options

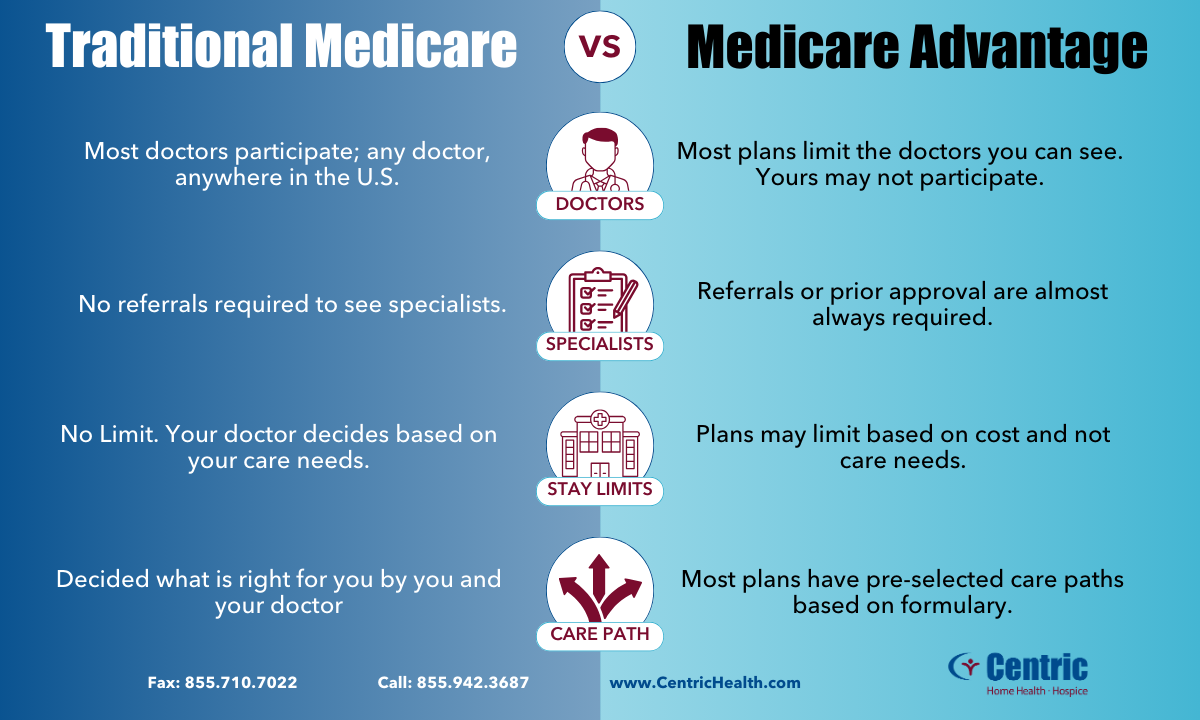

Making informed choices during Medicare Open Enrollment can be a daunting task. With a plethora of plans to choose from, each with its own complexities, it's easy to feel overwhelmed and confused. Understanding the nuances of Traditional Medicare, Medicare Advantage, and Medicare Part D, as well as deciphering the complexities of premiums, deductibles, co-pays, and out-of-pocket maximums can be a challenge. To ensure you make the best decision for your individual needs, it's crucial to take the time to research your options carefully or seek guidance from a trusted Medicare advisor.

- Traditional Medicare: This traditional plan consists of Part A (hospital insurance) and Part B (medical insurance). While it provides basic coverage, it often leaves gaps in areas like prescription drugs, dental, and vision care.

- Medicare Advantage Plans: Offered by private insurance companies, these plans combine Part A and Part B coverage, often with additional benefits like prescription drug coverage, dental, vision, and hearing aids.

Medicare Part D Prescription Drug Coverage

Medicare Part D is a prescription drug plan that helps cover the cost of medications. During Open Enrollment, you have the opportunity to enroll in a Part D plan if you don't currently have one, switch to a different Part D plan to find better coverage or lower costs, or drop your Part D plan if you no longer need prescription drug coverage. It's important to review your current plan's coverage, compare options, and consider your future medication needs to make informed decisions during Open Enrollment.

During Open Enrollment, you can:

- Enroll in a Part D plan if you haven't already.

- Switch to a different Part D plan to find better coverage or lower costs.

- Drop your Part D plan if you no longer need prescription drug coverage.

Navigating Open Enrollment: Key Steps

Navigating Medicare Open Enrollment requires careful planning and consideration. To make informed decisions, it's essential to review your current coverage, assess your future healthcare needs, compare plans carefully, understand the associated costs, and seek professional advice if needed. By taking these steps, you can ensure that you have the right Medicare coverage to meet your needs and budget.

- Review Your Current Coverage: Analyze your current plan's coverage, premiums, and deductibles.

- Project Your Future Needs: Make an educated guess about your healthcare needs in the upcoming year.

- Compare Plans Thoroughly: Use the official Medicare website (Medicare.gov) or consult with a licensed insurance agent to compare plans based on your needs and location.

- Pay Attention to Costs: Factor in premiums, deductibles, co-pays, and out-of-pocket maximums when comparing plans.

Open Enrollment Ends Soon!

Don't wait until the last minute if you need to explore new plans. The earlier you start comparing options, the more informed your choice will be. Open Enrollment is a limited-time window.

Don't miss this chance to make informed decisions about your Medicare coverage and ensure you have the protection you need for the next year with these additional resources:

- Medicare.gov: The official government website for Medicare information.

- Social Security Administration: Offers information and assistance with Medicare.

- State Health Insurance Assistance Programs (SHIPs): Provide free, unbiased counseling and assistance.

Centric Home Health and Hospice: Your Partner in Healthcare

Centric Home Health and Hospice, serving Oklahoma and North Texas, is dedicated to supporting you and your family throughout your healthcare journey. We recognize the complexities surrounding Medicare options. Our dedicated team can provide expert advice and assistance to help you understand your choices during Open Enrollment and make the best decision for your needs.

Making the right decisions during Medicare Open Enrollment can offer peace of mind and ensure you have the proper coverage for your current and anticipated healthcare needs. We encourage you to utilize this time effectively and remember, Centric Home Health and Hospice is here to support you every step of the way.

Learn more by contacting us, Centric Home Health and Hospice, at 1.855.942.3687 for more information because we give you the care you deserve! Interested in joining the team? See available opportunities and apply today!

Share This On Your Favorite App